How to Withdraw and make a Deposit in Coinbase

- Language

-

العربيّة

-

简体中文

-

हिन्दी

-

Indonesia

-

Melayu

-

فارسی

-

اردو

-

বাংলা

-

ไทย

-

Tiếng Việt

-

Русский

-

한국어

-

日本語

-

Español

-

Português

-

Italiano

-

Français

-

Deutsch

-

Türkçe

-

Nederlands

-

Norsk bokmål

-

Svenska

-

Tamil

-

Polski

-

Filipino

-

Română

-

Slovenčina

-

Zulu

-

Slovenščina

-

latviešu valoda

-

Čeština

-

Kinyarwanda

-

Українська

-

Български

-

Dansk

-

Kiswahili

How to Withdraw at Coinbase

How do I cash out my funds

To transfer cash from Coinbase to your linked debit card, bank account, or PayPal account, you first need to sell cryptocurrency to your USD wallet. After this, you can cash out the funds.Note that there is no limit on the amount of crypto you can sell for cash.

1. Sell cryptocurrency for cash

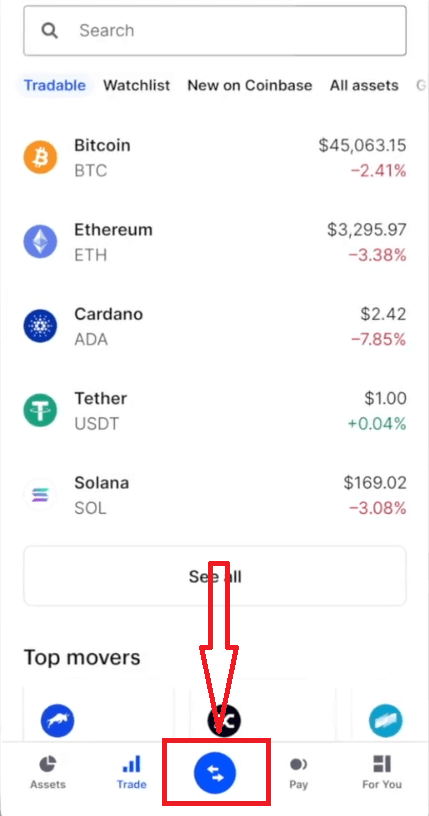

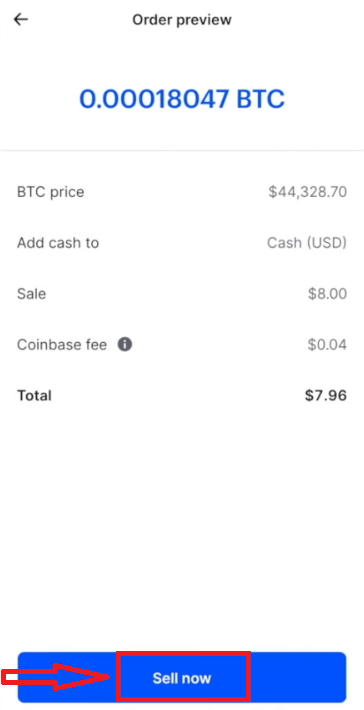

1. Click Buy / Sell on a web browser or tap the icon below on the Coinbase mobile app.

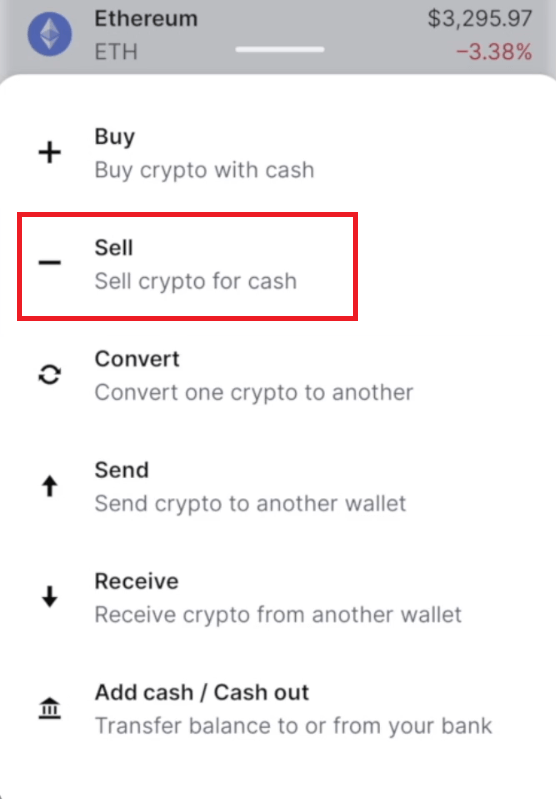

2. Select Sell.

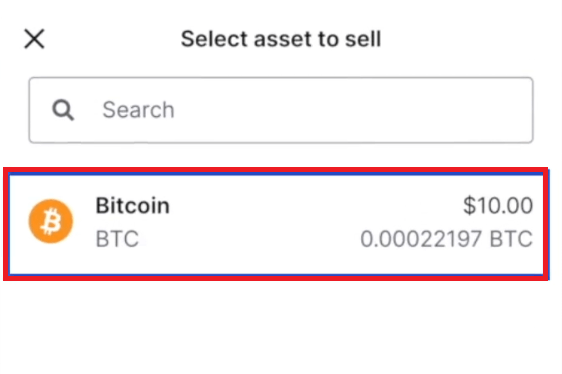

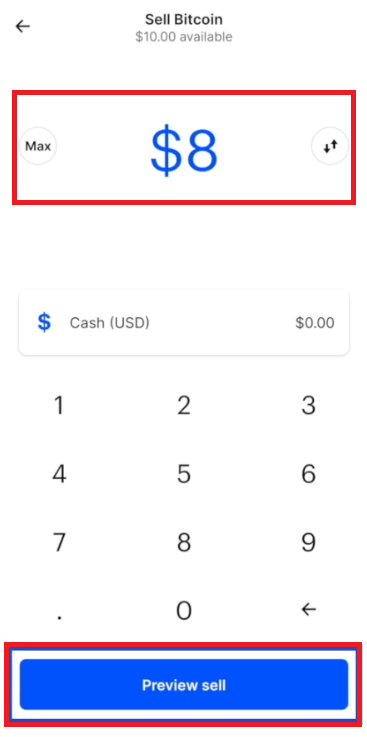

3. Select the crypto you want to sell and enter the amount.

4. Select Preview sell - Sell now to complete this action.

Once complete, then your cash will be available in your local currency wallet (USD Wallet, for example).

Note that you can immediately cash out your funds by tapping Withdraw funds in the Coinbase mobile app or Cash out funds from a web browser.

2. Cash out your funds

From the Coinbase mobile app:

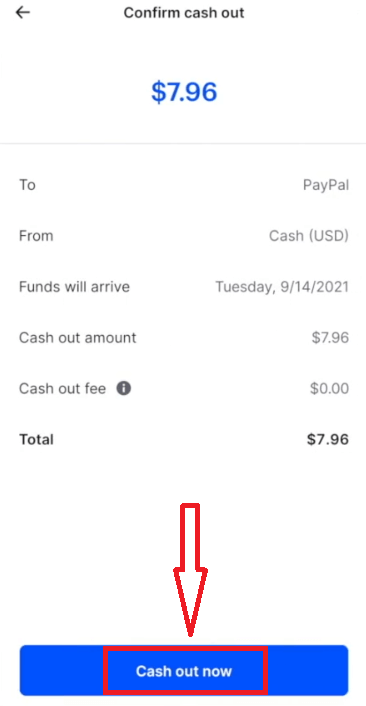

1. Tap Cash out

2. Enter the amount you want to cash out and choose your transfer destination, then tap Preview cash out.

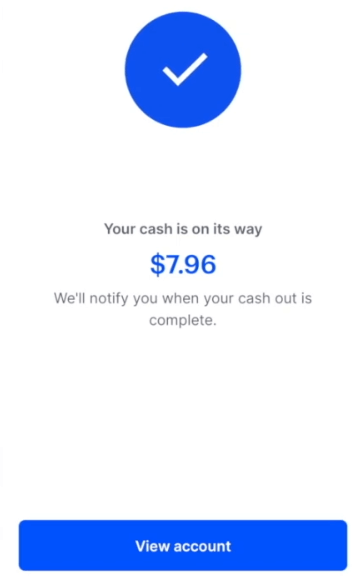

3. Tap Cash out now to complete this action.

When cashing out a sell from your cash balance to your bank account, a short holding period will be placed before you can cash out the funds from the sell. Despite the hold period, you are still able to sell an unlimited amount of your crypto at the market price you desire.

From a web browser:

1. From a web browser select your cash balance under Assets.

2. On the Cash out tab, enter the amount you want to cash out and then click Continue.

3. Choose your cash out destination and then click Continue.

4. Click Cash out now to complete your transfer.

Can I withdraw from my EUR wallet to my verified UK bank account?

At this moment, we do not support direct withdrawals from your Coinbase EUR wallet to your verified UK bank account. If you would like to withdraw from your EUR wallet via a SEPA transfer or another payment methods, please follow below.Coinbase supports the following payment methods for European customers in a supported country.

| Best For | Buy | Sell | Deposit | Withdraw | Speed | |

|

SEPA Transfer |

Large amounts, EUR deposits, Withdrawing |

✘ |

✘ |

✔ |

✔ |

1-3 business days |

|

3D Secure Card |

Instant crypto purchases |

✔ |

✘ |

✘ |

✘ |

Instant |

|

Instant Card Withdrawals |

Withdrawals |

✘ |

✘ |

✘ |

✔ |

Instant |

|

Ideal/Sofort |

EUR deposits, buy crypto |

✘ |

✘ |

✔ |

✘ |

3-5 business days |

|

PayPal |

Withdrawals |

✘ |

✘ |

✘ |

✔ |

Instant |

| Apple Pay* | Withdrawals | ✔ | ✘ | ✘ | ✘ | Instant |

Note: Coinbase currently does not accept physical checks nor bill pay as a payment method to purchase cryptocurrency or to deposit funds into a users fiat wallet. Checks will be returned to sender upon receipt via mail, provided a mailing address is present. And as a reminder, Coinbase customers can only have one personal Coinbase account.

Alternatively, if you would like to convert your funds from EUR to GBP and withdraw, follow these steps:

- Buy cryptocurrency using all the funds in your Coinbase EUR Wallet

- Sell cryptocurrency to your GBP Wallet

- Withdraw from your Coinbase GBP Wallet to your UK Bank Account via Faster Payment transfer

Frequently Asked Questions (FAQ)

When will funds be available to withdraw from Coinbase?

How to determine when funds will be available for withdrawal:

- Before confirming a bank purchase or deposit, Coinbase will tell you when the purchase or deposit will be available to send off Coinbase

- Youll see this labeled as Available to send off Coinbase on the website, or Available to withdraw on the mobile app

- Youll also be given options if you need to send instantly.

This is typically provided on the confirmation screen prior to processing a bank transaction.

Why arent funds or assets available to move or withdraw off Coinbase immediately?

When you use a linked bank account to deposit funds to your Coinbase fiat wallet, or use it to purchase cryptocurrency, this type of transaction is not a wire transfer such that Coinbase receives the funds immediately. For security reasons, you will not be able to immediately withdraw or send crypto off of Coinbase.There are a variety of factors that will determine how much time it may take until you can withdraw your crypto or funds off of Coinbase. This includes but is not limited to your account history, transaction history, and banking history. Withdrawal-based limit holds typically expire at 4 pm PST on the date listed.

Will my withdrawal availability affect other purchases?

Yes. Your purchases or deposits will be subject to any existing restrictions on the account, regardless of which payment method you used.In general, debit card purchases or wiring funds directly from your bank to your Coinbase USD wallet do not affect your withdrawal availability - if no restrictions exist on your account, you can use these methods to purchase crypto to send off of Coinbase immediately.

How long does a sell or cashout (withdrawal) take to complete?

Selling or cashing out using ACH or SEPA banking process:US Customers

When you place a sell order or cash out USD to a US bank account, the money usually arrives within 1-5 business days (depending on cashout method). The delivery date will be shown on the Trade Confirmation page before your order is submitted. You can see when the funds are expected to arrive on your History page. If you reside in one of the states that supports the Coinbase USD Wallet, sells into your USD Wallet will occur instantly.

European Customers

Since your local currency is stored within your Coinbase account, all buys and sells occur instantly. Cashing out to your bank account via SEPA transfer generally takes 1-2 business days. Cashout by wire should complete within one business day.

United Kingdom Customers

Since your local currency is stored within your Coinbase account, all buys and sells occur instantly. Withdrawing to your bank account via GBP bank transfer generally completes within one business day.

Canadian Customers

You can sell cryptocurrency instantly using PayPal to move funds out of Coinbase.

Australian Customers

Coinbase currently does not support selling cryptocurrency in Australia.

Selling or withdrawal using PayPal:

Customers in the US, Europe, UK, and CA, will be able to withdraw or sell cryptocurrency instantly using PayPal. To see what regional transactions are allowed and payout limits.

How to Deposit at Coinbase

Payment methods for US customers

There are several types of payment methods that you can link to your Coinbase account:

| Best for | Buy | Sell | Add cash | Cash out | Speed | |

| Bank Account (ACH) | Large and small investments | ✔ | ✔ | ✔ | ✔ | 3-5 business days |

| Instant Cashouts to bank accounts | Small withdrawals | ✘ | ✘ | ✘ | ✔ | Instant |

| Debit Card | Small investments and cashouts | ✔ | ✘ | ✘ | ✔ | Instant |

| Wire Transfer | Large investments | ✘ | ✘ | ✔ | ✔ | 1-3 business days |

| PayPal | Small investments and cashouts | ✔ | ✘ | ✔ | ✔ | Instant |

| Apple Pay | Small investments | ✔ | ✘ | ✘ | ✘ | Instant |

| Google Pay | Small investments | ✔ | ✘ | ✘ | ✘ | Instant |

To link a payment method:

- Go to the Payment Methods on web or select Settings Payment Methods on mobile.

- Select Add a payment method.

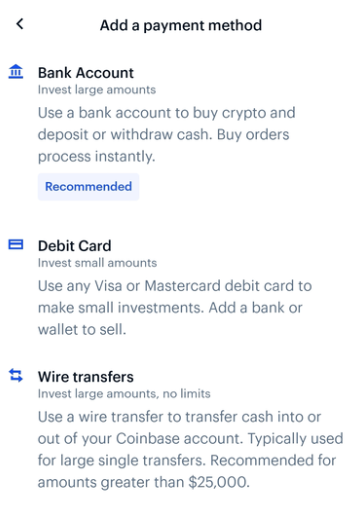

- Select the type of account you want to link.

- Follow the instructions to complete verification depending on the type of account being linked.

Please note: Coinbase does not accept physical checks or checks from bill pay services as a payment method to purchase cryptocurrency or to transfer cash into a users USD wallet. Any such checks received by Coinbase will be voided and destroyed.

How do I add a US payment method on the mobile app?

There are several types of payment methods that you can link to your Coinbase account. For more information on all the payment methods available to US customers, visit this help page.To link a payment method:

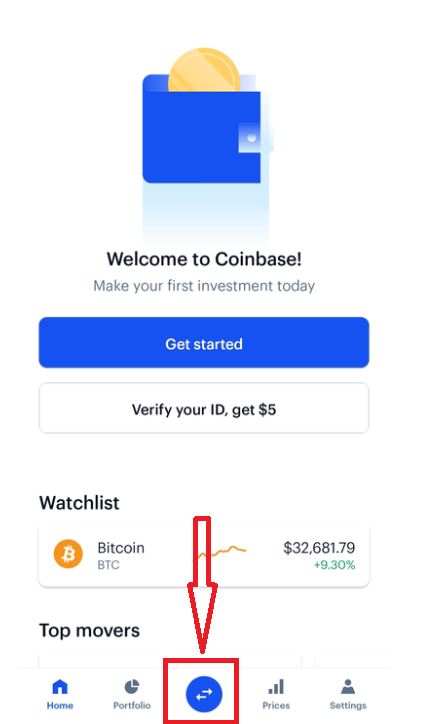

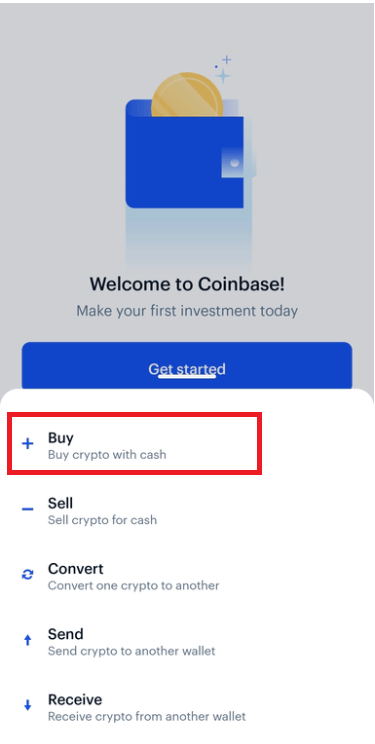

- Tap icon as below

- Select Profile Settings.

- Select Add a payment method.

- Select the payment method you want to link.

- Follow the instructions to complete verification depending on the type of payment method being linked.

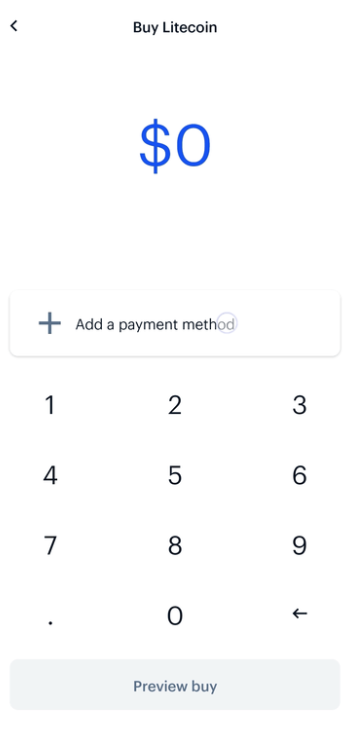

Adding a payment method while buying crypto

1. Tap the icon below at the bottom.

2. Select Buy and then select the asset you’d like to purchase.

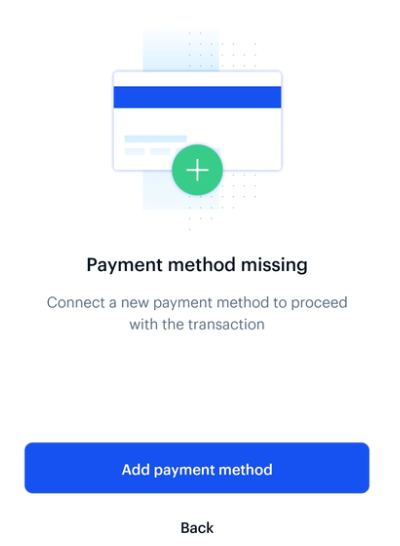

3. Select Add a payment method. (If you already have a payment method linked, tap your payment method to open up this option.)

4. Follow the instructions to complete verification depending on the type of payment method being linked.

If you link your bank account, please note that your banking credentials are never sent to Coinbase, but are shared with an integrated, trusted third-party, Plaid Technologies, Inc., to facilitate instant account verification.

How do I buy cryptocurrency with a credit or debit card in Europe and the UK?

You can buy cryptocurrency with a credit or debit card if your card supports "3D Secure". With this payment method, you will not have to pre-fund your account to buy cryptocurrency. You can purchase cryptocurrency instantly without waiting for a bank transfer to complete.To find out if your card supports 3D Secure, contact your credit/debit card provider directly or simply try adding it to your Coinbase account. You will get an error message if your card does not support 3D Secure.

Some banks require security steps to authorize a purchase using 3D Secure. These may include text messages, a bank provided security card, or security questions.

Please note, this method is not available for customers outside of Europe and the UK.

The following steps will get you started:

- When logged into your account, go to the Payment methods page

- Select Add a Credit/Debit Card at the top of the page

- Enter your card information (The address must match the billing address for the card)

- If needed, add a billing address for the card

- You should now see a window that says Credit Card Added and a Buy Digital Currency option

- You can now buy digital currency using the Buy/Sell Digital Currency page anytime

The following steps will walk you through the 3DS purchase process:

- Go to the Buy/Sell Digital Currency page

- Enter the desired amount

- Select the card on the payment methods drop down menu

- Confirm the order is correct and select Complete Buy

- You will be directed to your banks website (Process differs depending on bank)

How do I use my local currency wallet (USD EUR GBP)?

Overview

Your local currency wallet allows you to store funds denominated in that currency as funds in your Coinbase account. You can use this wallet as a source of funds to make instant purchases. You can also credit this wallet from the proceeds of any sale. This means you can instantly buy and sell on Coinbase, exchanging between your local currency wallet and your digital currency wallets.

Requirements

In order to activate your local currency wallet, you must:

- Reside in a supported state or country.

- Upload an identification document issued in your state or country of residence.

Set Up a Payment Method

In order to move local currency into and out of your account, youll need to set up a payment method. These methods will vary depending on your location. More information on various payment types can be found below:

- Payment Methods for US Customers

- Payment Methods for European Customers

- Payment Methods for UK Customers

Countries and states with access to local currency wallets

For customers in the US, local currency wallets are only available to states where Coinbase is either licensed to engage in money transmission, where it has determined that no such license is currently required, or where licenses are not yet being issued with respect to Coinbases business. This includes all US states with the exception of Hawaii.

Supported European markets include:

|

|

Can I buy cryptocurrency or add cash using PayPal?

Currently, only US customers are able to buy cryptocurrency or add US dollars using PayPal.All other customers are only able to use PayPal to cash out or sell, and transaction availability depends on region.

Buy-in and cash out limits (US only):

| US Transaction Type | USD | Rolling Limits |

|---|---|---|

| Cash out | $25,000 | 24 hours |

| Cash out | $10,000 | Per transaction |

| Add cash or buy | $1,000 | 24 hours |

| Add cash or buy | $1,000 | Per transaction |

Payout/cash out limits (Non-US)

| Rolling Limits | EUR | GBP | CAD |

|---|---|---|---|

| Per transaction | 7,500 | 6,500 | 12,000 |

| 24 hours | 20,000 | 20,000 | 30,000 |

The following table lists all supported PayPal transactions by region:

| Local Currency | Buy | Add Cash | Cash Out* | Sell | |

|---|---|---|---|---|---|

| US | USD | Cryptocurrency | USD | USD | None |

| EU | EUR | None | None | EUR | None |

| UK | EUR GBP | None | None | EUR GBP | None |

| CA | None | None | None | None | CAD |

*Cash out refers to a direct Fiat movement from a Fiat Wallet to an external source.

*Sell refers to an indirect Fiat movement from a Crypto Wallet to Fiat then to an external source.

Frequently Asked Questions (FAQ)

How do I verify my bank info?

When you add a payment method, two small verification amounts will be sent to your payment method. You must enter these two amounts correctly in your payment methods from your Settings in order to finish verifying your payment method.Attention

Linking your bank account is only available in these regions at this time: US, (most of) EU, UK.

In some cases, you may need to contact your bank.

Bank verification amounts are sent to your bank and appear on your online statement and on your paper statement. For faster verification, youll need to access your online bank account and search for Coinbase.

Bank Account

For bank accounts, the two amounts will be sent as credits. If you dont see your credits, please try the following:

- Check your upcoming or pending transactions in your online bank account

- You may need to check your full bank statement, as these transactions may be omitted from some online banking apps and websites. A paper statement may be necessary

- If you dont see these transactions, speak with your bank to help track down any hidden or omitted details on your statement. Some banks will merge the verification credits, showing only the total amount

- If none of the previous options work, visit your payment methods page and remove and re-add the bank to have the credits sent again. Re-sending the verification credits will void the first pair sent, so you may end up with more than one pair of verification credits

If you are using an "online bank" or similar banking product offered by your bank, you may not receive the verification credits. In this case, the only option is to try another bank account.

Debit Card

For cards, these verification amounts will be sent as charges. Coinbase will make two test charges to the card of amounts between 1.01 and 1.99 in your local currency. These should appear in the recent activity section of your card issuers website as pending or processing charges.

Please note:

- Charges for exactly 1.00 are not used for card verification and can be ignored. These are caused by the card processing network, and are separate from the Coinbase verification amounts

- Neither the verification amounts nor the 1.00 charges will post to your card—they are temporary. They will display as pending for up to 10 business days, then disappear.

If you dont see the verification amounts in your card activity, please try the following:

- Wait 24 hours. Some card issuers may take longer to display the pending amounts

- If you dont see the test charges appear after 24 hours, contact your bank or card issuer to ask if they can provide the amounts of any pending Coinbase authorizations

- If your card issuer is unable to find the charges, or if the amounts have already been removed, return to the payment methods page and select verify next to your card. You will see an option to re-charge your card at the bottom

- Sometimes your card issuer may flag one or all of these verification amounts as fraudulent and block the charges. If that is the case, you will need to contact your card issuer to stop the blocking, and then restart the verification process

How to successfully verify a billing address

If you receive an "Address did not match" error when adding a Visa or MasterCard debit card, it means the information you entered may not be verifying correctly with your credit cards issuing bank.To fix this error:

- Confirm that there are no missing characters or misspellings in the name and address you entered, and that the card number you are entering is correct.

- Make sure that the billing address you are entering is the same billing address that is on file with your card provider. If you have recently moved, for example, this information may be out of date.

- Enter only the street address on line 1. If your address contains an apartment number, do not add the apartment number in line 1.

- Contact your credit cards service number and verify the exact spelling of your name and address on file.

- If your address is on a numbered street, spell out the name of your street. For example, enter "123 10th St." as "123 Tenth St."

- If at this point you still receive an "address did not match" error please contact Coinbase support.

Also note that only Visa and MasterCard debit cards are supported at this time. Prepaid cards or cards without residential billing addresses, even those with the Visa or MasterCard logo, are not supported.

When will I receive my cryptocurrency from my card purchase?

Some payment methods such as credit and debit cards may require you to confirm all transactions with your bank. After starting a transaction, you may be sent to your banks website to authorize the transfer (Not applicable to US customers).Funds will not be debited from your bank, or credited to your Coinbase account, until the authorization process on your banks site is complete (US customers will see the bank transfer complete immediately with no confirmation through your bank). This process usually only takes a few minutes. If you choose to not authorize the transfer, no funds will be transferred and the transaction will usually expire after about one hour.

Note: Only applicable to certain US, EU, AU, and CA customers.

What is the minimum amount of cryptocurrency that I can purchase?

You can purchase or sell as little as 2.00 of digital currency denominated in your local currency ($2 or €2 for example). - Language

-

ქართული

-

Қазақша

-

Suomen kieli

-

עברית

-

Afrikaans

-

Հայերեն

-

آذربايجان

-

Lëtzebuergesch

-

Gaeilge

-

Maori

-

Беларуская

-

አማርኛ

-

Туркмен

-

Ўзбек

-

Soomaaliga

-

Malagasy

-

Монгол

-

Кыргызча

-

ភាសាខ្មែរ

-

ລາວ

-

Hrvatski

-

Lietuvių

-

සිංහල

-

Српски

-

Cebuano

-

Shqip

-

中文(台灣)

-

Magyar

-

Sesotho

-

eesti keel

-

Malti

-

Македонски

-

Català

-

забо́ни тоҷикӣ́

-

नेपाली

-

ဗမာစကာ

-

Shona

-

Nyanja (Chichewa)

-

Samoan

-

Íslenska

-

Bosanski

-

Kreyòl